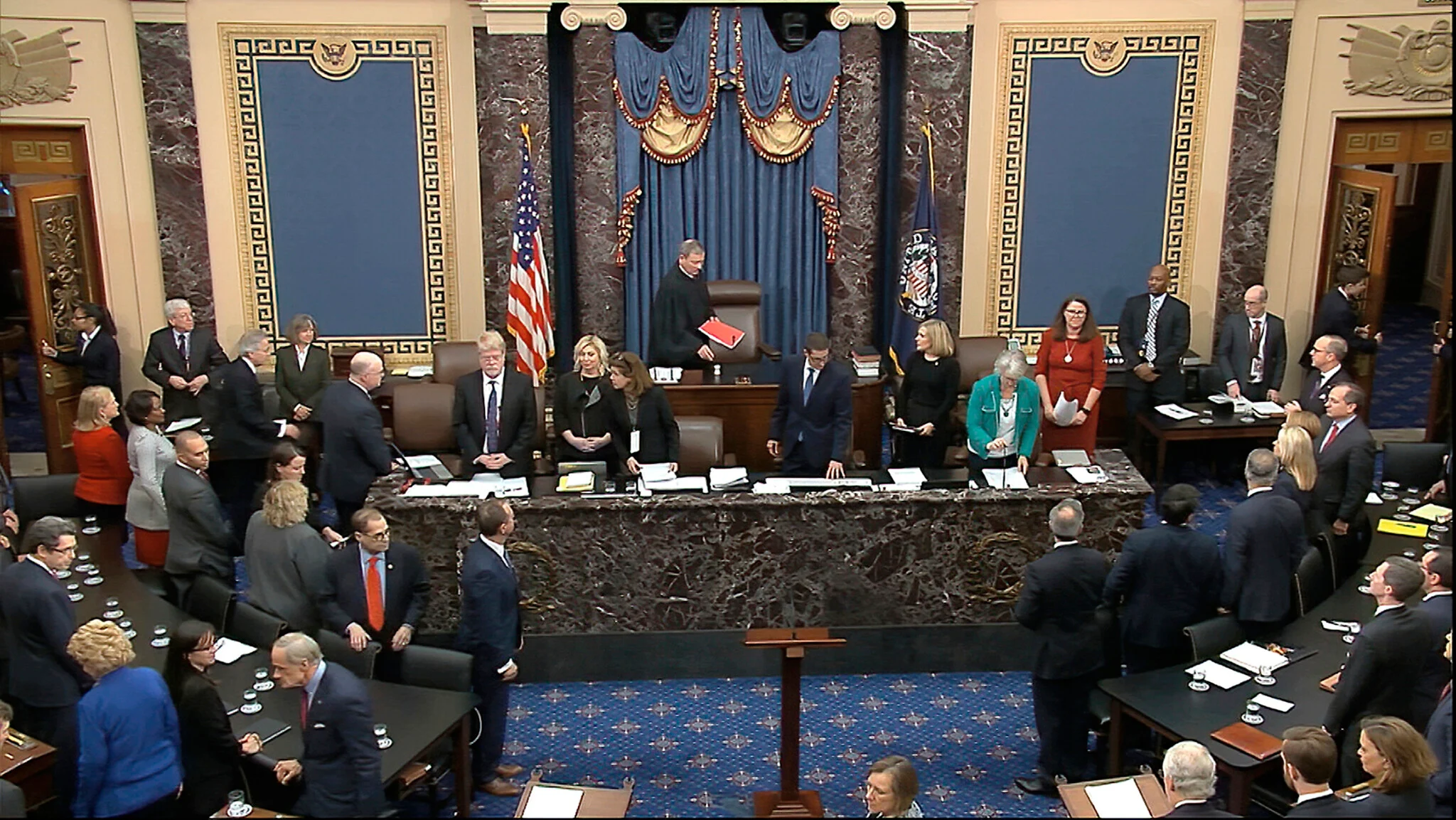

Unexpected Winners and Clear Losers Emerge as U.S. Senate Passes Sweeping Tax Bill

As the U.S. Senate passes a sweeping new tax bill—hailed by some as historic and criticized by others as shortsighted—markets, industries, and policymakers are quickly digesting its full implications. While the bill promises simplified tax structures, lower corporate rates, and broad incentives for innovation, it also introduces adjustments that will have starkly different impacts across sectors.

Winners: Tech, Manufacturing, and Multinationals

1. Big Tech and AI Firms

Technology giants appear to be among the biggest winners. With R&D tax credits expanded and AI-related investments eligible for additional deductions, the bill supports continued innovation in emerging technologies. Companies operating in cloud computing, semiconductors, and artificial intelligence stand to gain significantly from favorable depreciation allowances and repatriation incentives.

2. U.S.-Based Manufacturers

Domestic manufacturers benefit from lower corporate tax rates and “reshoring credits” aimed at encouraging companies to bring production back to U.S. soil. This is expected to boost capital expenditure and job creation in key industrial states.

3. Multinational Corporations

A one-time tax break on repatriated foreign earnings gives multinationals the opportunity to bring billions of dollars back to the U.S. at a discounted rate. This could translate into increased shareholder returns and domestic reinvestment.

Losers: Renewable Energy, High-Tax States, and Certain Consumers

1. Renewable Energy Sector

While the bill favors fossil fuel producers with new capital write-offs and relaxed environmental penalties, tax credits for solar and wind have been trimmed. The move has drawn criticism from clean energy advocates who say it could slow down the energy transition just as global demand for sustainability rises.

2. Residents of High-Tax States

Individuals in states like California, New York, and Illinois are poised to lose out due to caps on state and local tax (SALT) deductions. This will disproportionately affect high-income earners in urban centers and may accelerate outmigration trends to lower-tax states.

3. Middle-Class Households in Some Brackets

While the bill includes modest tax cuts for many Americans, the benefits are uneven. Households with dependents in certain income ranges may see smaller-than-expected savings due to adjustments in deduction thresholds and sunset provisions that could raise rates again in five years.

Political and Economic Reactions

Republican lawmakers praised the bill as a pro-growth overhaul aimed at boosting U.S. competitiveness and private sector investment. “This legislation will stimulate job creation, reward innovation, and deliver meaningful relief to American businesses,” said one senator closely involved in drafting the bill.

Democrats, on the other hand, warned of ballooning deficits and long-term inequality. Several senators argued the bill disproportionately favors the wealthy and corporations while offering only temporary relief to average families.

Economists remain split. Some predict a short-term boost in GDP and stock market activity, while others caution that rising interest rates and deficit spending could weigh down the economy in the medium term.

Market Response

Financial markets responded favorably, with major indices hitting fresh highs amid optimism over corporate tax relief. The S&P 500, Dow Jones, and Nasdaq all posted gains in early trading following the bill’s passage.

Conclusion

As the dust settles, the new tax bill is likely to reshape America’s economic landscape for years to come. While some industries prepare to scale up under new incentives, others will need to recalibrate strategies to remain competitive. What remains certain is that tax policy will remain a key battleground as economic conditions, technological change, and political dynamics continue to evolve.