The Return of the Multiplier Trade: How a Banned Chinese Bond Strategy Is Quietly Doubling Yields Again

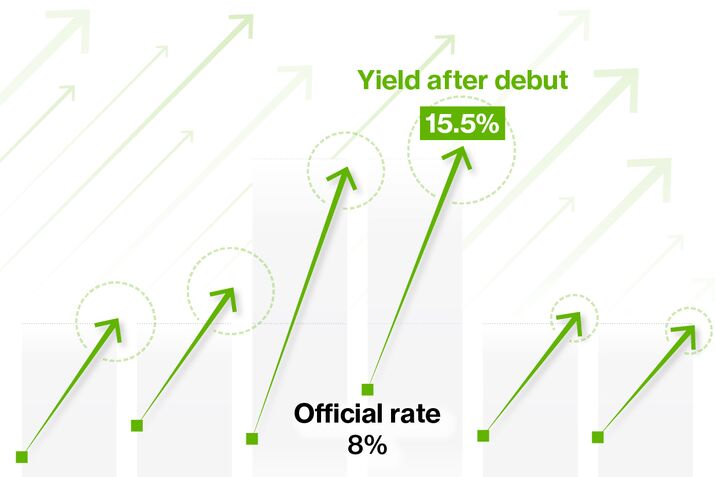

A controversial Chinese bond strategy once outlawed by regulators — a financial engineering maneuver capable of turning an 8% yield into a staggering 16% return — is making an aggressive comeback. Despite crackdowns aimed at curbing leverage, off–balance sheet lending, and hidden debt risks, the so-called yield-doubling tactic has resurfaced across China’s vast fixed-income ecosystem, revealing persistent demand for high returns in a sluggish economy and exposing gaps in regulatory oversight.

Its reemergence signals a deeper truth: China’s financial system, constrained by low growth and capital controls, continues to rely on creative — and often opaque — ways to generate returns, even at the risk of inflating new bubbles.

What Is the Banned Tactic — and Why Did Regulators Try to Shut It Down?

At the heart of the revival is a once-prohibited mechanism commonly used by local government financing vehicles (LGFVs), brokerages, and banks seeking to boost investment yields without openly violating leverage caps.

The structure typically involves:

- High-yield local government bonds (often 7%–8% coupons)

- Layered financing or structured repos

- Implicit guarantees from local governments

- Shadow leverage hidden through trust firms or channel banks

By recycling collateral, borrowing against it, and reinvesting repeatedly — sometimes three or four times — institutions effectively double or even triple the nominal return.

An 8% bond suddenly behaves like a 16%–20% yield machine.

Regulators banned the tactic because it:

- Masked true leverage

- Amplified credit risk

- Enabled hidden LGFV financing

- Threatened financial stability

- Fueled speculative bubbles

Despite reforms designed to shut it down, the strategy has mutated — and now it’s back.

Why Is the Strategy Roaring Back Now?

The resurgence is not accidental. It is the direct result of mounting pressures across China’s financial system.

1. A Weak Economy Is Pushing Investors Toward Higher Returns

China is experiencing:

- Sluggish GDP growth

- Deflationary pressures

- A property crisis still unresolved

- Falling household confidence

- Weak corporate profits

In this environment, a conventional 8% LGFV bond looks attractive — but a leveraged 16% return looks irresistible.

2. LGFVs Are Desperate for Funding

Local governments are under fiscal strain, facing:

- Collapsing land sales revenue

- Heavy infrastructure debt

- Social spending pressures

Bond issuance is one of the last remaining oxygen lines for local authorities. The multiplier tactic helps boost demand for their bonds.

3. Regulatory Fatigue and Loophole Evolution

The Chinese financial system is highly adaptive. Each time regulators close one loophole, financial engineers invent another:

- New trust structures

- “White list” LGFV guarantees

- Structured repo agreements

- Cross-bank collateral transformation

The core technique is the same — the packaging just evolves.

4. Investors Trust Implicit Guarantees

Despite repeated warnings, many institutions still believe that Beijing will not allow widespread local government defaults.

This moral hazard fuels demand for “safe high-yield” opportunities.

How the New Version of the Tactic Works

The modern iteration of the banned strategy often takes the form of:

• Structured repos with disguised leverage

Banks repo LGFV bonds to investors, who then pledge them again to obtain more financing.

Each cycle magnifies yield.

• Trust loan layering

Trust companies build multi-tier lending products that rest on the same underlying collateral but appear on different balance sheets.

• Channel bank cooperation

Banks facilitate transactions without recording full risk exposure, effectively becoming intermediaries for shadow leverage.

• Local government “comfort letters”

Soft guarantees that encourage institutions to treat the bonds as low-risk — even when the issuers are deeply indebted.

The returns grow, but so does the fragility.

Why This Is Risky — Even if It Seems Stable

The risks echo past crises, but with new characteristics.

1. Hidden leverage still inflates systemic risk

When the same bond becomes collateral multiple times, a single issuer wobble can trigger:

- Margin calls

- Forced selling

- Liquidity cascades

- Contagion across institutions

2. LGFV solvency is worsening

Although defaults are rare, financial stress is rising:

- Over 50% of LGFVs lack cash flow to meet interest payments

- Bond maturities are accelerating

- Local governments cannot rely on real estate revenue anymore

A highly leveraged environment magnifies these vulnerabilities.

3. Shadow banking could re-expand

China spent half a decade trying to shrink shadow banking.

This tactic could reopen the floodgates, reigniting systemic instability.

4. The illusion of safety encourages reckless behavior

Implicit guarantees have historically created complacency:

- Investors assume local governments won’t default

- Local governments assume Beijing will backstop them

- Beijing assumes markets will self-correct

This circular logic is dangerous.

Why Beijing Is Letting It Happen — For Now

China’s leadership is trying to balance two competing priorities:

1. Prevent financial collapse

Beijing intervenes when risks spike — but prefers not to force a purge of LGFV debt that could trigger mass defaults.

2. Maintain economic stability

Stimulus remains cautious, so the government is tolerating “contained risk-taking” to lubricate financial flows.

If the multiplier tactic helps keep:

- LGFVs funded

- Banks stable

- Markets active

The government may tolerate it temporarily — as long as it doesn’t spiral.

What Happens Next?

The revival of the banned tactic signals deeper structural stress in China’s financial system.

Possible Scenarios:

1. Regulators Crack Down Again

When risks rise, Beijing could:

- Ban structured repos

- Tighten trust product approval

- Restrict LGFV bond issuance

- Increase disclosure requirements

This would trigger volatility but reduce long-term risk.

2. Controlled Tolerance

China may allow the tactic selectively to keep liquidity flowing — especially in regions with high debt burdens.

3. A Slow-Burn Crisis

If multiple LGFVs face repayment issues simultaneously, leveraged holders could panic, creating a cascading sell-off.

4. Bond Market Stabilization

If fiscal stimulus increases or restructured LGFV frameworks are introduced, the need for shadow leverage may decline.

Conclusion: A Dangerous Return Wrapped in Quiet Stability

The reappearance of the banned yield-doubling tactic reveals a system under strain — one where investors crave returns, local governments crave liquidity, and regulators balance caution with necessity.

Unlike past cycles, China today has stronger tools, deeper liquidity, and more experience managing financial risk.

But the underlying forces that produced the 16% shadow-yield tactic remain troublingly familiar.

China’s multiplier trade is roaring back — and while it’s not yet a crisis, it is a warning.