SoftBank Shifts Strategy: Exits Nvidia Stake to Double Down on OpenAI with $30 Billion Bet

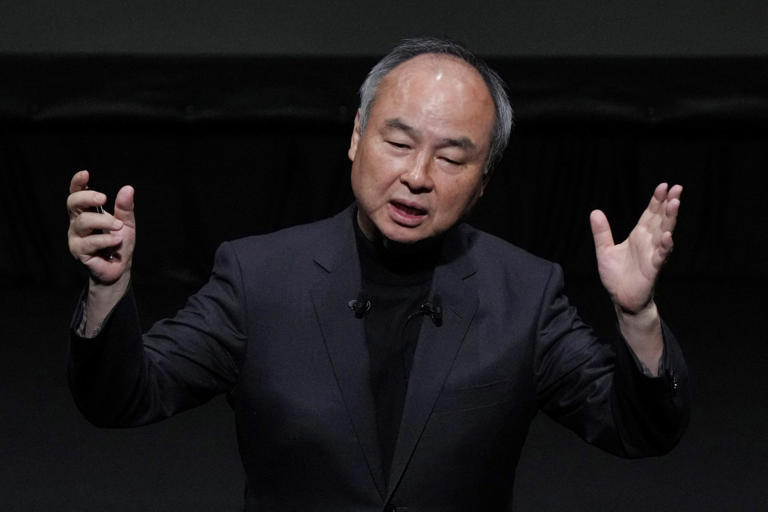

In a bold and high-stakes move, SoftBank Group Corp. has sold its entire $5.8 billion stake in Nvidia, the leading semiconductor giant, signaling a dramatic pivot in its technology investment strategy. The Japanese conglomerate’s CEO, Masayoshi Son, is simultaneously committing an unprecedented $30 billion to OpenAI, the artificial intelligence research powerhouse behind ChatGPT. The move underscores SoftBank’s aggressive pursuit of AI-driven innovation while recalibrating its portfolio away from traditional semiconductor plays.

SoftBank’s Nvidia Exit: A Major Portfolio Shake-Up

SoftBank’s divestment of its Nvidia shares marks a turning point in its approach to the semiconductor sector. Nvidia, a company long synonymous with AI hardware acceleration and gaming graphics, has been a cornerstone of SoftBank’s Vision Fund strategy. By liquidating the $5.8 billion position, SoftBank effectively exits a high-performing asset that has been central to the AI infrastructure ecosystem.

The sale comes amid soaring valuations for Nvidia, which recently reported strong revenue from data center demand and generative AI applications. Analysts suggest that SoftBank’s move reflects a strategic choice to consolidate exposure to AI software and services, rather than hardware, betting on the long-term transformative potential of platforms like OpenAI.

Doubling Down on OpenAI

Masayoshi Son’s $30 billion commitment to OpenAI represents one of the largest private sector investments in an AI company to date. The capital injection will likely be deployed across multiple fronts, including model development, infrastructure expansion, and AI commercialization initiatives.

SoftBank has consistently framed AI as the next frontier of technological disruption, and OpenAI is now central to its vision. By concentrating resources on OpenAI, SoftBank aims to:

- Accelerate AI Development

OpenAI has rapidly advanced generative AI capabilities, including natural language understanding, multi-modal models, and AI-assisted software. SoftBank’s investment could enable the firm to scale its research infrastructure and push boundaries in next-generation AI applications. - Capture Market Dominance

By investing heavily in a leading AI company, SoftBank positions itself as a key stakeholder in the emerging AI ecosystem, potentially gaining influence over commercialization strategies and intellectual property rights. - Leverage AI for Portfolio Synergies

SoftBank may integrate AI-driven tools across its broader Vision Fund investments, spanning healthcare, robotics, telecommunications, and cloud computing. Centralizing resources around OpenAI allows the conglomerate to harness AI innovation across sectors.

Strategic Implications for the Tech Sector

SoftBank’s move carries profound implications for the broader technology landscape:

a) AI Investment Intensification

The $30 billion OpenAI investment represents a massive infusion of capital, signaling that leading conglomerates see generative AI as the next transformative platform. This could spur additional investments from global tech funds, venture capitalists, and corporate giants seeking exposure to the AI revolution.

b) Hardware vs. Software Shift

Exiting Nvidia suggests a shift in emphasis from AI hardware to software-driven AI platforms. While Nvidia remains critical for powering AI workloads, SoftBank appears to prioritize companies that can develop AI applications and services, rather than chip production.

c) Market Signaling and Investor Confidence

Such a decisive reallocation of capital sends a signal to investors: SoftBank is betting big on AI supremacy. While the move carries risk—given OpenAI’s high valuation and the competitive nature of AI research—it underscores a broader trend of tech investment concentrating on software, platforms, and AI-driven solutions.

Risks and Considerations

Despite the strategic rationale, SoftBank’s aggressive pivot entails significant risks:

- Concentration Risk: Allocating $30 billion to a single company increases exposure to potential setbacks in AI development, regulatory scrutiny, or competitive disruption.

- Valuation Uncertainty: OpenAI’s valuation has surged in recent years, but market dynamics for AI platforms are still volatile. Returns may be long-term and unpredictable.

- Hardware Dependency: While SoftBank exits Nvidia, AI models remain dependent on high-performance chips. Overlooking hardware dynamics could limit operational flexibility.

- Regulatory and Ethical Challenges: AI regulation is evolving globally. Policies around AI safety, privacy, and ethical use may impact OpenAI’s commercialization strategies and, by extension, SoftBank’s investment outcomes.

Broader Market and Industry Impact

SoftBank’s actions could reshape investment trends across the technology sector:

- Other tech conglomerates and investment funds may reevaluate their exposure to AI hardware versus software.

- AI startups may receive heightened attention and capital inflows, potentially accelerating innovation but also inflating valuations.

- Nvidia’s stock may experience short-term volatility as a major institutional investor exits, though long-term demand for AI chips is expected to remain robust.

This strategic shift highlights a defining moment in the tech industry, where software-led AI platforms are increasingly viewed as the dominant frontier, overshadowing the hardware that underpins them.

Conclusion

SoftBank’s sale of its $5.8 billion Nvidia stake and the simultaneous $30 billion commitment to OpenAI marks a dramatic reorientation of one of the world’s most influential technology investors. Masayoshi Son’s strategy underscores a growing conviction that generative AI platforms, rather than semiconductor manufacturing, will drive the next wave of technological and economic transformation.

While the move entails risk, it signals a decisive bet on the AI revolution and may influence how global investors allocate capital in the rapidly evolving technology sector. For SoftBank, the stakes could not be higher—but the potential rewards, if OpenAI continues to dominate the AI landscape, are unprecedented.