China Gains Strategic Edge as Sanctions Cripple Russia’s Steel Industry

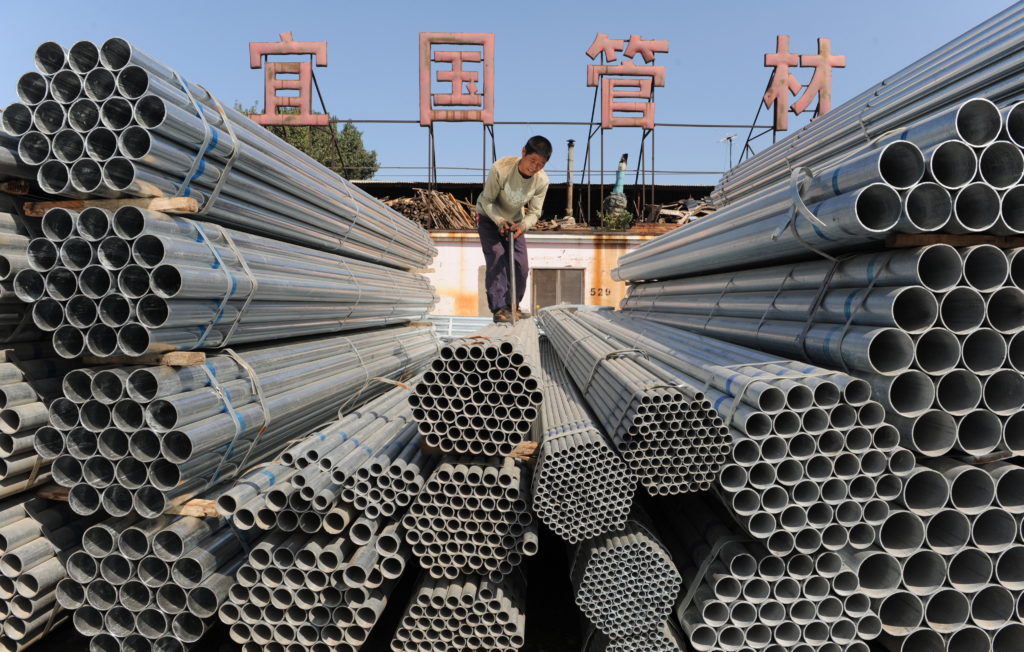

As Western sanctions tighten against Russia in response to ongoing geopolitical tensions, the fallout is reshaping the global steel market—and China is emerging as the biggest beneficiary. With Russian steel production and exports severely constrained, China is expanding its influence, filling supply gaps and strengthening its position in key global markets.

Russia’s Steel Sector Under Pressure

Since 2022, Russia’s steel industry—once a dominant player in Europe and parts of Asia—has been hit by multiple rounds of sanctions. These restrictions target not just steel exports but also access to critical machinery, financing, and global logistics, creating a ripple effect across the supply chain.

Major Russian steel producers such as Severstal, MMK, and NLMK have seen significant declines in output and international orders, as Western buyers reduce exposure and logistics networks become fragmented.

China Steps Into the Vacuum

With Russia’s steel footprint contracting, China has seized the opportunity to expand its market share in regions previously served by Russian mills—particularly in Southeast Asia, the Middle East, and parts of Africa.

Key factors behind China’s strategic gains include:

- Surplus capacity and production efficiency: China’s domestic steel output remains strong, giving it room to redirect exports.

- Competitive pricing: With costs optimized by scale and state-backed infrastructure, Chinese steel remains cost-effective.

- Trade relationships: Beijing is leveraging the Belt and Road Initiative to strengthen trade ties and facilitate steel exports to partner nations.

- Currency advantage: A relatively stable yuan compared to the ruble gives China stronger purchasing and negotiating power in international markets.

Realignment of Global Steel Trade

The disruption in Russian steel flows has triggered a realignment of global supply chains. European and North American buyers are turning to alternative sources such as Turkey, India, and South Korea. However, China remains the most dominant exporter, thanks to its infrastructure, capital backing, and fast delivery capability.

At the same time, developing countries are increasingly turning to China for financing and material supply for infrastructure projects, creating long-term dependencies that favor Beijing’s strategic and economic interests.

Geopolitical Implications

China’s growing dominance in the steel sector is not just an economic win—it has broader geopolitical consequences. With steel being a cornerstone of infrastructure, defense, and industrial manufacturing, Beijing’s influence over this supply chain enhances its leverage in global negotiations.

Meanwhile, Russia’s diminished industrial capacity could weaken its bargaining position in non-energy sectors and further increase its economic dependence on China, especially in raw material trade and bilateral project development.

Conclusion

As sanctions continue to squeeze Russia’s steel sector, China is rapidly capitalizing on the shifting dynamics, expanding its footprint in global markets and fortifying its role as a central industrial power. The realignment offers Beijing a unique opening to strengthen both its economic reach and political influence—solidifying a win that may outlast the current crisis.