Al Maktoum Finance Secures USD 100 Million Equity Stake in Prime Group Singapore to Accelerate Africa’s Oil & Gas Growth Ahead of SGX Listing

In a landmark move set to reshape Africa’s emerging energy landscape, Al Maktoum Finance, operating under the Office of H.H. Sheikh AbdulHakim Al Maktoum Group Holdings, has signed a future USD 100 million share acquisition agreement with Prime Group Singapore. The strategic investment, executed through Al Maktoum Finance’s Capital Protection Division, marks one of the most significant pre-IPO capital commitments in the region’s oil and gas sector.

The agreement positions Al Maktoum Finance as a major equity stakeholder in Prime Group as the company advances its ambitious expansion across Africa’s high-value energy markets. The investment will directly support Prime Group’s acquisition and development of premium oil and gas assets ahead of its planned Reverse Takeover (RTO) and Singapore Exchange (SGX) listing target for 2026.

A Cornerstone Investment Powering Africa’s Next Energy Chapter

The USD 100 million equity infusion serves as a foundational component of Prime Group’s pre-IPO capital strategy. It enables the company to:

- Accelerate the consolidation of high-yield African energy assets

- Fuel its asset development and revaluation phase

- Strengthen financial structuring ahead of the RTO

- Prepare for an SGX listing designed to unlock institutional-scale capital

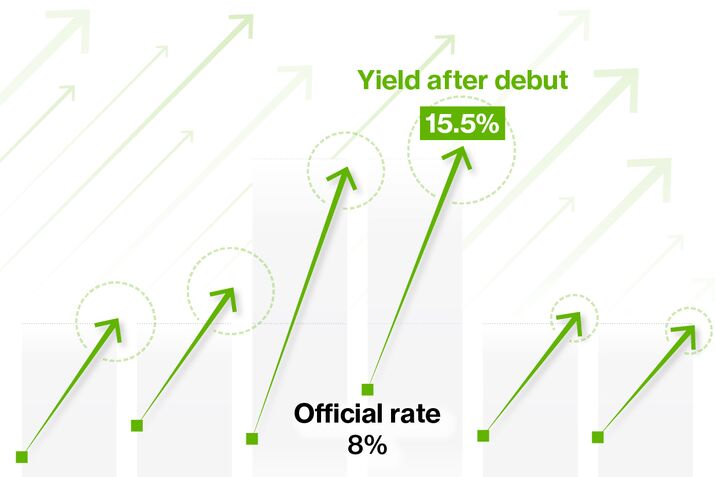

Prime Group’s listing strategy aims to create one of the most transparent, institutional-grade African energy portfolios available to global markets. The company forecasts a 10x investor return within the first 18 months post-listing — driven by asset-backed valuation uplift, operational expansion, and strategic bond issuances.

Aligned Visions: Economic Sovereignty, Energy Growth, and Sustainable Development

A spokesperson for Al Maktoum Finance’s Capital Protection Division underscored the long-term significance of the acquisition:

“Our mission is to position our Holding Group in world-class growth business opportunities. Prime Group’s disciplined investment model, proven non-operator strategy, and commitment to advancing Africa’s economic sovereignty align precisely with our mandate.

This acquisition of strategic energy assets — projected to drive more than 300% revenue growth — stands as a cornerstone in Prime Group’s long-term expansion plan and a powerful value-creation opportunity for our investors.”

The alignment between both organizations extends beyond capital deployment. It reflects a shared vision of fostering sustainable development, strengthening national resource independence, and mobilizing institutional finance to unlock Africa’s vast untapped potential.

Prime Group: A New Phase of Accelerated Expansion

Prime Group CEO Karim Bouhout described the partnership as a turning point in the organization’s global strategy:

“This signed agreement with Al Maktoum Finance represents a major vote of confidence in our asset-backed growth strategy and our trajectory toward a public listing.

Partnering with such a prestigious institution reinforces the credibility of our operational model and our ability to unlock meaningful value across Africa’s resource sector. This capital infusion accelerates our development roadmap — including asset revaluation and a strategic bond issuance — aimed at supporting energy independence and economic growth for our host nations.”

Prime Group plans to channel the new capital into key initiatives such as:

- Large-scale oil and gas acquisition pipelines

- Enhanced geological and asset revaluation programs

- Strengthened regional partnerships

- Structuring of a sovereign-backed bond issuance to support long-term growth

This strategic acceleration is expected to significantly enhance the company’s position ahead of its SGX debut.

About Prime Group

Prime Group is a diversified international investment and trading platform headquartered in Singapore, specializing in oil, mining, and agricultural assets across the African continent. Under the leadership of CEO Karim Bouhout, Prime Group operates with a disciplined non-operator investment model, partnering with globally recognized institutions — including China National Petroleum Corporation (CNPC) — to deliver strong, risk-adjusted returns.

The Group is committed to advancing sustainable development, supporting economic sovereignty, and developing Africa’s high-growth resource sectors through transparent, institutional-grade investment structures.