U.S. Construction Industry Squeezed by New Tariffs as Material Costs Soar

The U.S. construction sector is under growing financial pressure following the imposition of new tariffs on key imported materials, prompting concerns over project delays, budget overruns, and slowed growth in both commercial and residential building.

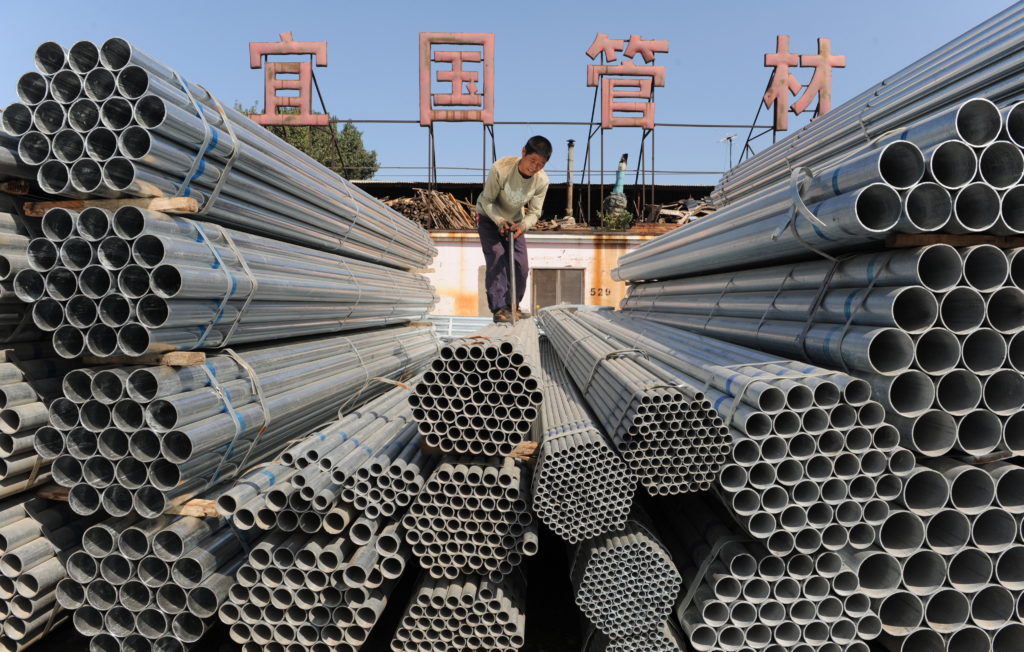

The latest round of trade tariffs—targeting imports of steel, aluminum, lumber, and manufactured construction components—has led to a notable spike in material prices across the board. Developers and contractors now face elevated costs on everything from structural beams to electrical equipment, squeezing already thin profit margins and increasing the overall cost of development.

Rising Material Prices Disrupt Project Pipelines

Industry analysts report that some materials have risen by as much as 15% to 25% in recent months, directly linked to the new tariffs imposed on countries like China, Canada, and parts of the European Union. These increases are affecting all types of construction, from large-scale infrastructure projects to residential housing.

“We’re seeing a significant uptick in supplier quotes almost weekly,” said a spokesperson for the National Association of Home Builders (NAHB). “Projects that were financially viable six months ago are now being re-evaluated or delayed.”

Small Builders Hit Hardest

While large construction firms may have the resources to absorb some of the cost increases or renegotiate supplier contracts, small and mid-sized builders are bearing the brunt of the changes. Many are being forced to pass higher costs on to customers or reduce project scopes to remain within budget.

“This puts local builders in a tough spot,” noted David Warren, a construction economist. “They’re caught between fixed-price contracts and rising costs—something has to give.”

Broader Economic Impacts

The ripple effects of rising construction costs could be felt across the broader U.S. economy. Increased housing prices, delayed public works projects, and reduced investment in new commercial spaces may contribute to slower economic growth in sectors tied to real estate and infrastructure development.

Additionally, the tariffs risk exacerbating existing supply chain issues, especially for components that are not easily sourced domestically. Industry leaders have called for more clarity and long-term policy direction to avoid continued uncertainty.

Policy Debate Continues

The Biden administration has defended the tariffs as part of a broader strategy to protect U.S. manufacturing and reduce dependence on foreign supply chains. However, trade associations and industry groups are lobbying for exemptions or rollbacks, warning that continued pressure on the construction sector could undermine the administration’s own infrastructure goals.

As the debate unfolds, construction companies across the country are recalculating bids, adjusting procurement strategies, and seeking alternative suppliers—steps that may buffer short-term shocks but underscore the need for a more stable trade environment.

Conclusion

With material prices climbing and economic uncertainty growing, the U.S. construction industry is navigating one of its most challenging cost environments in recent years. Unless tariffs are eased or offset by other policy measures, builders and developers may face prolonged volatility—impacting jobs, housing supply, and critical infrastructure projects nationwide.